Carbon Market

Emissions-Intensive Trade-Exposed (EITE) Companies

Some companies whose main competitors are located in territories where carbon pricing requirements are not as strict lack the necessary leverage within their markets to increase the price of their products. They cannot expect to recover all the costs incurred by carbon pricing without the risk of losing market shares.

In addition, this limited ability to transfer the cost associated with carbon pricing can be diminished still further if a company’s GHG emissions are significant and the costs they entail account for a considerable portion of its operating costs. Such companies are described as emissions-intensive trade-exposed (EITE).

Two main measurements are used to identify EITE companies:

- Trade exposure assessment

This assessment indicates the theoretical capacity of a company to transfer the carbon cost it must pay to its customers. It is obviously a limited indirect indicator, since only the company knows its real capacity to transfer its carbon cost to its customers. Using this theoretical basis, the higher the trade exposure ratio in a sector of activity, the more reasonable it is to assume that it will be difficult to transfer the carbon cost.

The formula used to calculate the trade exposure ratio is:

(Exports + Imports)

(Domestic production + Imports)

Proportionately speaking, many industrial establishments in Québec are trade exposed. In general, the trade exposure ratio in the sectors in which Québec’s industrial emitters operate varies from 30 to 100%, with an average value of over 80%.

-

Emission intensity

This assessment indicates the theoretical impact of carbon pricing on a company’s production costs. For example, companies that produce goods of higher GHG emission intensity could be impacted more significantly by carbon pricing. Measuring emission intensity therefore allows for assessing the impact of carbon pricing on a company’s business model and wealth creation process.

The following formula is used to estimate a sector’s or company’s carbon emission intensity:

GHG emissions

GDP

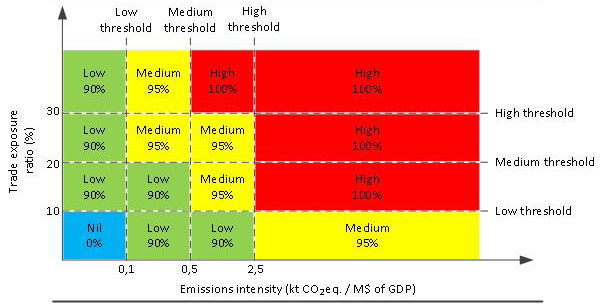

By using a combination of these two measurements, the carbon leakage risk level of companies can be established and, in this way, companies that will be able to benefit from the allocation of free emission units can be determined. The following chart shows the classification that was chosen.

Level of carbon leakage risk

Validity of data

The data used to define EITE companies and sectors were derived from numerous sources. The analysis of EITE companies and sectors is based on data that has been verified by a third party as well as on trade statistics, government data, and investigations.

As of 2010, all industrial establishments in Québec that emit 10,000 t CO2 eq. or more annually must declare their GHG emissions according to the requirements of the Ministère de l’Environnement et de la Lutte contre les changements climatiques (MELCC) under the Regulation respecting mandatory reporting of certain emissions of contaminants into the atmosphere.

As of 2012, all emitters covered by the C&T system must also declare their production data and have their emission declarations verified by a third party accredited to ISO 14065 by a member of the International Accreditation Forum under an ISO 17011 program.